Latest Version

Version

4.9.2

4.9.2

Update

March 10, 2023

March 10, 2023

Developer

INDmoney: Stocks, Mutual Funds, SIP, FD in One App

INDmoney: Stocks, Mutual Funds, SIP, FD in One App

Categories

Finance

Finance

Platforms

Android

Android

Downloads

4

4

License

Free

Free

Report

Report a Problem

Report a Problem

More About INDmoney: Stocks, Demat & MFslication

INDmoney: India ka Super Money App

All-in-one app to invest, save, plan & track your money

⚡SIP in Stocks & ETFs with Free Demat & Trading a/c

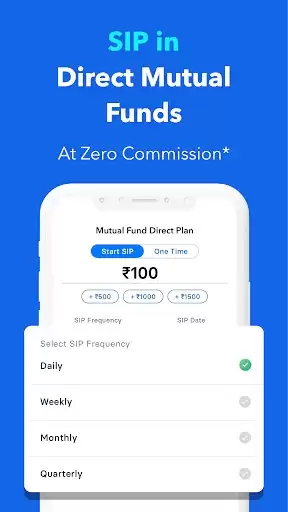

⚡Invest in Direct Plan Mutual Funds at Zero Commission**

⚡Book Fixed Deposits

⚡Track bank a/cs like ICICI, HDFC, Kotak, Axis etc, in one place

⚡Track net worth across family members

⚡Learn finance with IND Learn courses

⚡Mini Save: Invest in FDs by saving daily

⚡Get Free credit score

🚀Invest in the stock market

✨Open Free Demat & Trading a/c at Zero AMC (Annual Maintenance Charges)^

✨SIP in Indian Stocks & ETFs

✨Setup SIP with autopay via UPI

✨Invest across large cap, mid cap, small cap stocks & ETFs

✨Get live share prices from NSE, BSE

🚀Direct Plan Mutual Funds at Zero Commission

✨Invest in 5000+ Direct Plan Mutual Funds

✨Start SIP in MFs starting at ₹10

✨Switch from Regular to Direct Plan

✨Insights such as taxation, performance etc.

✨Manage all transactions: STP, SIP, SWP

🚀US Stock investments from India at Zero Brokerage

✨Open Free US Stocks a/c in less than 3 mins with a regulated US stocks a/c broker like DriveWealth, Alpaca LLC

✨Invest in 6000+ US Stocks like Apple, Netflix, Amazon & 600+ US ETFs at Zero AMC

✨Invest in fractions with as low as $1

✨Check live prices of Nasdaq, NYSE, S&P500

🚀TRACK your finances in 1 dashboard

✨Securely track your investments, expenses, goals, insurance, savings a/c balances, credit cards & more!

✨Track stocks, Mutual Funds across brokers, banks & finance apps

✨Track ESOPs/RSU’s, EPFO & more

🚀INsta Cash (for whitelisted users)

• Repayment tenure: 3-60 months; Max APR: 12%-28% P.A, Loan Processing Fees (incl. GST): 0.5%-3%, Bounce Charges: ₹400-450 (excl. GST), Penal Charges: 24%-36% P.A on overdue amount

• Lending Partners: Kisetsu Saison Finance India Private Limited: https://creditsaison.in/partnercontact/, IDFC FIRST Bank Limited: https://www.idfcfirstbank.com/personal-banking/adlp/digital-lending-partners/finzoomers-services-private-limited

• Eg: Loan Amt.: ₹10,100; Interest: 14% p.a

APR: 14.001% p.a; Tenure: 6 mo; PF (incl. GST): ₹100;

EMI: ₹1,753; Total Interest: ₹416; Disbursal Amt: ₹10,000. Amt Payable: ₹10,516.

• Finzoomers Services (P) Ltd that is a subsidiary of Finzoom Investment Advisors (P) Ltd (“Finzoom”) offers its services through the INDmoney platform, which is operated by Finzoom.

Secure, Safe & Fast

✨Strict data security policies & encryption with OTP & biometric-based access

✨Stored data is highly secure & encrypted

✨ISO 27001:2013 certified. Assessed as per Google cloud application security assessment by Google authorised lab, & CERT-In Empanelled auditors.

✨Blogs are for educational purposes only & shouldn’t be construed as financial, investment, tax, accounting or legal advice

^INDmoney Private Limited is a registered stockbroker & depository participant. SEBI

Registration No. INZ000305337, SEBI DP Registration No. IN-DP-690-2022, DP ID: CDSL 12095500, Trading & Clearing Member of NSE (90267, M70042) & BSE (6779). For details, please visit www.indmoney.com;

Investment Advisory Services are provided by Finzoom. SEBI Registered Investment Advisor: INA100012190.

**Mutual Funds transaction facilitation services are provided by Finzoom in partnership with BSEStarMF

Facilitation of US Stocks trading through Stockbroker-Dealer like Drivewealth & Alpaca which are registered with USA Securities Exchange Commission. T&C apply.

*Finzoomers Services Private Limited is a company registered with the Insurance Regulatory & Development Authority of India (“IRDAI”) as a Corporate Agent (Composite) vide registration no. CA0744 & also carries out various facilitation activities like acting as a digital platform for opening of FDs, opening of digital savings bank a/c.

For grievances related to Stock Broking/DP, please write to instockssupport@indmoney.com

T&Cs: https://www.indmoney.com/terms-of-services

Privacy Policy: https://www.indmoney.com/privacy-policy

Customer service: support@indmoney.com

⚡SIP in Stocks & ETFs with Free Demat & Trading a/c

⚡Invest in Direct Plan Mutual Funds at Zero Commission**

⚡Book Fixed Deposits

⚡Track bank a/cs like ICICI, HDFC, Kotak, Axis etc, in one place

⚡Track net worth across family members

⚡Learn finance with IND Learn courses

⚡Mini Save: Invest in FDs by saving daily

⚡Get Free credit score

🚀Invest in the stock market

✨Open Free Demat & Trading a/c at Zero AMC (Annual Maintenance Charges)^

✨SIP in Indian Stocks & ETFs

✨Setup SIP with autopay via UPI

✨Invest across large cap, mid cap, small cap stocks & ETFs

✨Get live share prices from NSE, BSE

🚀Direct Plan Mutual Funds at Zero Commission

✨Invest in 5000+ Direct Plan Mutual Funds

✨Start SIP in MFs starting at ₹10

✨Switch from Regular to Direct Plan

✨Insights such as taxation, performance etc.

✨Manage all transactions: STP, SIP, SWP

🚀US Stock investments from India at Zero Brokerage

✨Open Free US Stocks a/c in less than 3 mins with a regulated US stocks a/c broker like DriveWealth, Alpaca LLC

✨Invest in 6000+ US Stocks like Apple, Netflix, Amazon & 600+ US ETFs at Zero AMC

✨Invest in fractions with as low as $1

✨Check live prices of Nasdaq, NYSE, S&P500

🚀TRACK your finances in 1 dashboard

✨Securely track your investments, expenses, goals, insurance, savings a/c balances, credit cards & more!

✨Track stocks, Mutual Funds across brokers, banks & finance apps

✨Track ESOPs/RSU’s, EPFO & more

🚀INsta Cash (for whitelisted users)

• Repayment tenure: 3-60 months; Max APR: 12%-28% P.A, Loan Processing Fees (incl. GST): 0.5%-3%, Bounce Charges: ₹400-450 (excl. GST), Penal Charges: 24%-36% P.A on overdue amount

• Lending Partners: Kisetsu Saison Finance India Private Limited: https://creditsaison.in/partnercontact/, IDFC FIRST Bank Limited: https://www.idfcfirstbank.com/personal-banking/adlp/digital-lending-partners/finzoomers-services-private-limited

• Eg: Loan Amt.: ₹10,100; Interest: 14% p.a

APR: 14.001% p.a; Tenure: 6 mo; PF (incl. GST): ₹100;

EMI: ₹1,753; Total Interest: ₹416; Disbursal Amt: ₹10,000. Amt Payable: ₹10,516.

• Finzoomers Services (P) Ltd that is a subsidiary of Finzoom Investment Advisors (P) Ltd (“Finzoom”) offers its services through the INDmoney platform, which is operated by Finzoom.

Secure, Safe & Fast

✨Strict data security policies & encryption with OTP & biometric-based access

✨Stored data is highly secure & encrypted

✨ISO 27001:2013 certified. Assessed as per Google cloud application security assessment by Google authorised lab, & CERT-In Empanelled auditors.

✨Blogs are for educational purposes only & shouldn’t be construed as financial, investment, tax, accounting or legal advice

^INDmoney Private Limited is a registered stockbroker & depository participant. SEBI

Registration No. INZ000305337, SEBI DP Registration No. IN-DP-690-2022, DP ID: CDSL 12095500, Trading & Clearing Member of NSE (90267, M70042) & BSE (6779). For details, please visit www.indmoney.com;

Investment Advisory Services are provided by Finzoom. SEBI Registered Investment Advisor: INA100012190.

**Mutual Funds transaction facilitation services are provided by Finzoom in partnership with BSEStarMF

Facilitation of US Stocks trading through Stockbroker-Dealer like Drivewealth & Alpaca which are registered with USA Securities Exchange Commission. T&C apply.

*Finzoomers Services Private Limited is a company registered with the Insurance Regulatory & Development Authority of India (“IRDAI”) as a Corporate Agent (Composite) vide registration no. CA0744 & also carries out various facilitation activities like acting as a digital platform for opening of FDs, opening of digital savings bank a/c.

For grievances related to Stock Broking/DP, please write to instockssupport@indmoney.com

T&Cs: https://www.indmoney.com/terms-of-services

Privacy Policy: https://www.indmoney.com/privacy-policy

Customer service: support@indmoney.com

Rate the App

Add Comment & Review

User Reviews

Based on 2 reviews

"Futuristic Trading app"

Rahul Kumar

2 years ago

This the only Indian app which gives bother National & International trading options .

"Trusted trading app"

Gouri Mahanta

2 years ago

I am using INDmoney trading app since 1yr plus. It's very easy to use. This is the only app which provides best experience to buy US stock including Indian stock. Definitely recommend

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Other Apps in This Category

More »

Popular Apps

Free Fire MAX 5Garena International I

Groww: Stocks & Mutual Fund 5Groww - Stock Trading, Demat, Mutual Funds, SIP

Turbo VPN - Secure VPN Proxy 5Innovative Connecting

Upstox- Stocks & Demat Account 5Upstox - Stock Market Trading & Demat Account App

INDmoney: Stocks, Demat & MFs 5INDmoney: Stocks, Mutual Funds, SIP, FD in One App

SuperVPN Fast VPN Client 5SuperSoftTech

Honɵygain. Earn Money. 5EittoSoft

Angel One: Stocks, Demat & IPO 5Angel One - Stock Market, Demat Account & IPO

GameZop : Best Free Games Online 5Advergame Technologies Pvt. Ltd.

Peer2Profit - Earn Money 5Peer2Profit LLC

More »

Editor's Choice

GameZop : Best Free Games Online 5Advergame Technologies Pvt. Ltd.

ySense 5Prodege

SweatcoinSweatco Ltd

Google Opinion RewardsGoogle LLC

Swagbucks: Surveys for MoneyProdege

INDmoney: Stocks, Demat & MFs 5INDmoney: Stocks, Mutual Funds, SIP, FD in One App

Angel One: Stocks, Demat & IPO 5Angel One - Stock Market, Demat Account & IPO

Kite by Zerodha 5Zerodha

Upstox- Stocks & Demat Account 5Upstox - Stock Market Trading & Demat Account App

Groww: Stocks & Mutual Fund 5Groww - Stock Trading, Demat, Mutual Funds, SIP

iOS

iOS